CARGO INSURANCE CLAUSES

Sets of standard clauses published by the Institute of London Underwriters (see below for a brief description of who and what the ILU is) provide a policy wording on which of cargo insurance may be based.

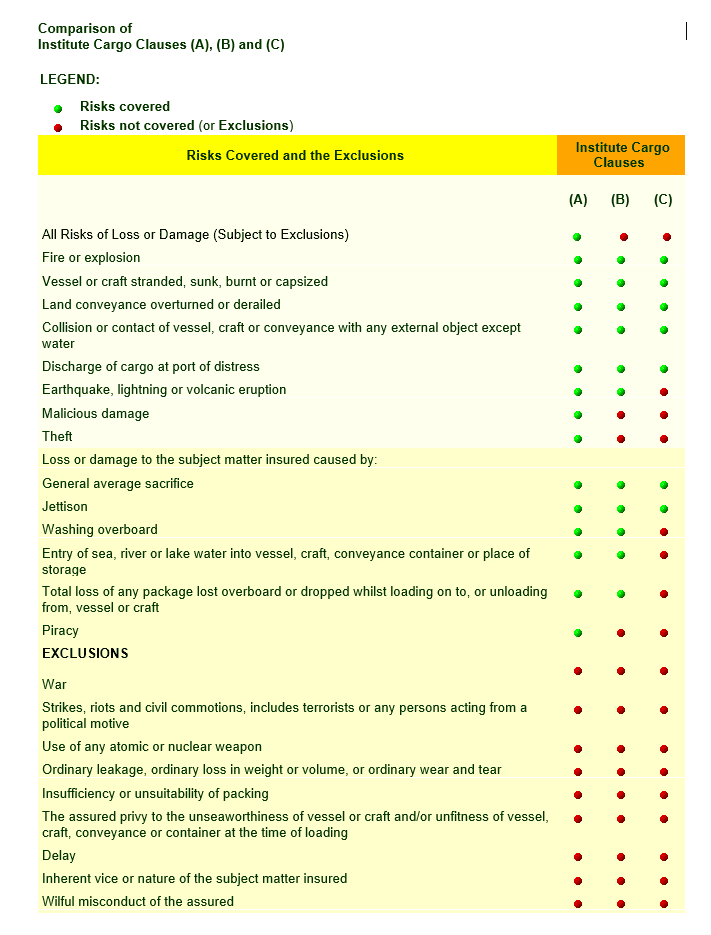

There are three sets of standard Institute Cargo Clauses which were introduced in 1982 and these are the A, B and C sets of conditions. These three clauses all provide the following cover for total loss (actual and constructive) damage to the insured goods, general average, expenses to prevent or reduce loss (sue & labour charges and salvage charges).

INSTITUTE CARGO CLAUSE “A”

The Institute Cargo Clauses ‘A’ embraces “all risks” of loss of or damage to the cargo insured. The cover provided must result from a fortuity or accidental means and it should be borne in mind that perils are not insured but risks are.

RISK – A fortuity. Something which MAY happens but not something which MUST happen. Does not include an inevitability.

INSTITUTE CARGO CLAUSES “B”

The Institute Cargo Clauses “B” do not cover “all risks” but it provides indemnity against loss or damage caused by specific events such as Fire, Explosion, Stranding, Sinking, Capsizing, Overturning, Derailment, Collision, Earthquake, Lightning and Discharge of Cargo at a port of distress. Also covers total loss of any package lost overboard or dropped during loading or unloading. Jettison or Washing overboard and General Average sacrifices.

INSTITUTE CARGO CLAUSE “C”

This particular clause covers loss or damage similar to the “B” clauses except losses caused by earthquake, lightning and washing overboard.

EXCLUSIONS

All three clauses have the same exclusions.

| War |

| Strikes, riots and civil commotions, includes terrorists or any persons acting from a political motive |

| Use of any atomic or nuclear weapon |

| Ordinary leakage, ordinary loss in weight or volume, or ordinary wear and tear |

| Insufficiency or unsuitability of packing |

| The assured privy to the unseaworthiness of vessel or craft and/or unfitness of vessel, craft, conveyance or container at the time of loading |

| Delay |

| Inherent vice or nature of the subject matter insured |

| Wilful misconduct of the assured |

OTHER SPECIFIC CLAUSES TO BE USED FOR SPECIFIC COMMODITIES

- Institute Cargo Clauses (Air Cargo)

- Institute Bulk Oil Clauses

- Institute Commodity Trades Clauses (A) (B) (C) – Used for Hides, Skins, Leather, Bulk Metals, Oil Seeds, Raw or Refined Sugar, Tea, Cotton, Fats

- Institute Frozen Food Clauses (A) and (C)

- Institute Frozen Meat Clauses (A) and (C)

War and Strikes Risks are Excluded under all Marine Clauses but can be purchased separately an additional premium.

APPROPRIATE CLAUSES

Institute War Clauses (Cargo)

Institute War Clauses (Air Cargo)

Institute Strikes Clauses (Cargo)

Definitions:

General Average Sacrifice: There is a general average act when, and only when, any extraordinary sacrifice or expenditure is intentionally and reasonably made or incurred for the common safety for the purpose of preserving from peril the property involved in a common maritime adventure.

Jettison: The intentional throwing overboard of part of the cargo or some piece of the ship in order to save the ship or its cargo.

History of the ILU (Institute of London Underwriters)

The Institute was set up in 1884 as the trade association for the company market specialising in marine, aviation and transportation insurance business. In 1986 the companies who made up the membership of the Institute joined together under one roof to form a marketplace where insurance brokers could broke their business with insurance companies in the same way as they did at Lloyd’s.

The ILU building in Leadenhall Street/Billiter Street had insurance companies who were the Institute’s members trading on five of the seven floors. The Institute was funded by way of subscription from its member companies and also by charges levied on throughput of business where ILU policies were issued on behalf of the companies subscribing to co-insurance risks.

At the end of 1998 the ILU merged with LIRMA (the London Insurance and Reinsurance Market Association) which was the trade association acting for non-marine insurance companies. This move was driven by companies who wrote both marine and non-marine business and saw the value in having one trade association to represent them and to act as an administrative and policy signing and accounting bureau.

Thus the IUA (the International Underwriting Association of London) was set up on 1 January 1999 and all the ILU’s then members ceased their membership of the Institute and became members of the IUA.